How To Boost Conversions

By Eliminating Payment Hurdles

Adam Blair, Executive Editor • Published March 21, 2017

Adam Blair, Executive Editor • Published March 21, 2017

When mobile payments are streamlined, the results can be dramatic. When Pep Boys optimized the mobile site customer experience, results were impressive:

“When people go to the mobile web, it’s often at that ‘moment of need,” explained Brendan Miller, Principal Analyst, Forrester. Optimizing purchase processes for these highly motivated consumers can therefore yield impressive results.

This Retail TouchPoints Special Report will explore the most effective ways for retailers to streamline their payment processes at every touch point and on every screen, large and small.

Macro Efforts To Make Payments Friction-Free: While the W3C preps standards to embed consumer payment data directly into web browsers, retailers can start streamlining payment by reducing the number of checkout form fields and investing in autofill and back-end technology.

Will One-Click Payment Become Table Stakes?: The expiration of Amazon’s patent on its one-touch payment process is opening the field to other providers, but retailers need to ensure they have earned customers’ trust if they expect them to share payment data.

Lower Hurdles To Raise Conversion Rates: Retailers need to A/B test checkout and payment processes to ensure they are as smooth as possible, offering guest checkout options and postponing customer queries as long as possible.

New Devices, New Security Concerns: Rapid development of IoT devices that spread commerce to consumers’ homes and cars are potentially adding new “attack vectors” for hackers.

The drive to streamline payment processes is proceeding on multiple fronts. The World Wide Web Consortium (W3C) has established a Web Payments Interest Group that is developing standards to embed consumers’ payment data directly into web browsers. Adoption and use of these standards would allow a wide range of online retailers to simplify payment processes, without requiring shoppers to submit payment card data for transactions at each retailer.

Retailers don’t need to wait for these standards to be developed, however, to begin their own streamlining process. “When we talk to retailers about simplifying the checkout experience, we commonly find that there are way too many form fields for shoppers to fill out,” said Forrester’s Miller in an interview with Retail TouchPoints. “Too often retailers’ mobile checkout is a mirror image of their desktop checkout, but no one wants to fill out a lot of form fields on a mobile device.”

Retailers can take advantage of APIs in Chrome and Safari mobile web browsers that autofill fields with data users have saved, and a Google Maps API can perform address verification, speeding approvals.

Even a small tweak has the potential to make a big difference. “Retailers need to ensure that when a consumer does have to fill in a field, say for a zip code or a telephone number, that a numerical keypad comes up rather than an alphabet keypad,” said Miller. “You would be surprised how many retailers have not yet made the effort to implement these kinds of task flow reductions on their mobile checkouts.”

Behind the scenes, retailers need to make sure that if they have customer’s payment data on file that the information stays up-to-date. Providers like Cayan can take this card data and put it in a secure “vault,” mitigating the risk of data breaches for retailers while tying the data to a shopper’s login credentials. “We will do things in the background to ensure that the information stays updated,” said Henry Helgeson, CEO of Cayan. “The abandonment rate can be pretty high even if a shopper sitting on the couch has to walk 25 feet to get his new card information — and as an alternative there’s Amazon, which has one-click payment, right in front of him. Getting the abandonment rate down so that the consumer can check out with the latest payment data is really important.”

Revamping checkout processes — and using carefully monitored A/B testing techniques to ensure the process is optimized for the preferences of that retailer’s customer base — is a smart investment. “We have very good data about consumer behavior and what’s driving the path to purchase with e-Commerce, and we know that any impediment you put in front of a customer will slow them down,” said Eric Shea, Managing Director at Kurt Salmon, part of Accenture Strategy.

Retailers also should consider adding a “guest checkout” option, allowing shoppers to complete a purchase without requiring anything more than the basic information needed to process a payment. While the brand gives up an opportunity to gather valuable shopper data, it boosts conversion rates and sets the stage for a return visit.

If a retailer does want to find out more about its shoppers, Shea recommends pushing queries to the end of the purchase journey. “Any time a consumer is asked a question — even if it’s just something simple like ‘Would you like this shipped to your home or business address?’ — there’s a direct correlation to abandonment,” he noted in an interview with Retail TouchPoints. “Let the consumer have their browsing experience and add things to their cart, without forcing them to log in or provide personal information. The more a retailer can get a shopper to explore, browse, engage and learn more about products, the more likely they will be to complete the transaction.”

Amazon’s patent on its one-click payment process will expire in September 2017, and payment industry experts predict that other providers will soon be offering similar functionality. “There is tremendous value in it — Apple wouldn’t be licensing the Amazon technology if they didn’t think it was incredibly valuable,” said Miller. “We also see with Android Pay and PayPal that these ‘instant’ payment methods are moving in on Amazon’s experience.”

PayPal’s version of one-touch payment allows retailers to “capture the point of need-based demand as fast as they can,” said Amit Mathradas, General Manager and Head of Small Business, North America for PayPal. This functionality is currently offered by five million merchants and used by more than 40 million consumers, with usage rates over 80%, according to Mathradas.

There is a danger that payments can become too easy, or at least be perceived that way by shoppers. “Online retailers are all trying to remove friction from e-Commerce, but then a question arises for the shopper: Do you trust your information to be stored with these retailers to enable this streamlined experience?” said Shea. “The brands that have established high levels of loyalty will be able to implement a streamlined path to purchase because they are trusted by consumers.”

The Accenture consumer study indicated that trust is the biggest driver of customer loyalty in the digital age, with 85% of U.S. consumers saying they are loyal to brands that are trustworthy and protect their information. More than three out of four (76%) U.S. consumers say it is extremely frustrating realizing that companies they do business with cannot be trusted to look after their personal information.

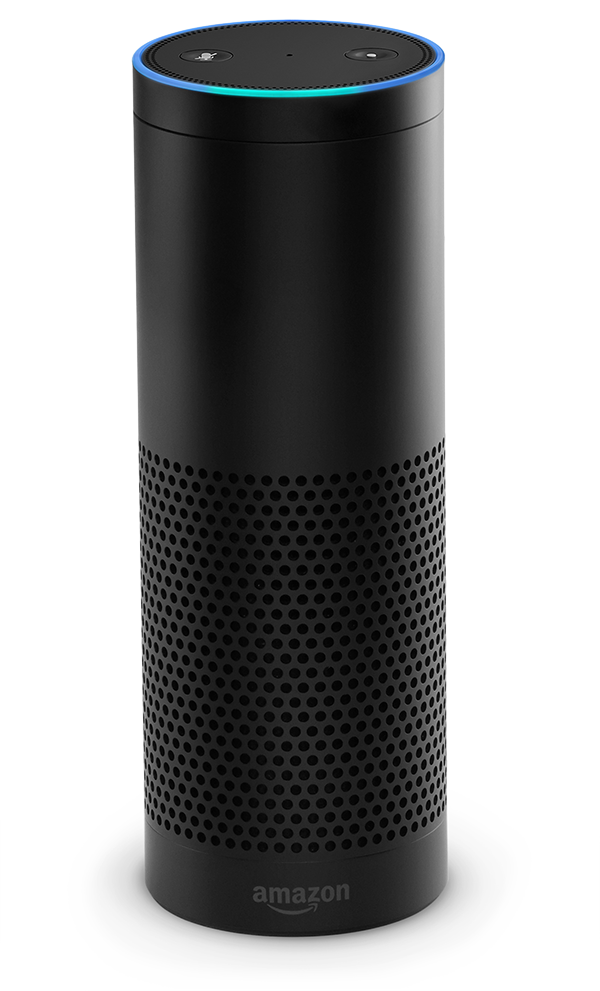

Amazon’s 1-Click ordering revolutionized the e-Commerce checkout experience and set the bar for what customers have come to think of as an easy shopping experience. It’s become such a staple for regular Amazon users that the company even expanded the concept beyond the virtual world of the internet — now, many people place Amazon Dash Buttons throughout their home and use them to reorder common household supplies with the push of a button.

What many merchants don’t realize is that Amazon has a patent on 1-click — not just the technology, but the very concept. No company in the United States is allowed to sell online with just one click unless they get licensed by Amazon. Apple, for instance, licensed 1-click ordering from Amazon in 2000.

But all of that will be over soon. Amazon’s patent expires in September 2017. And that’s a big deal for everyone with an e-Commerce web site, whether you’re a huge national chain or a local merchant.

One-click checkout is about to be everywhere, because removing friction from the buying process is perhaps the biggest priority for modern businesses. In brick-and-mortar stores, this has meant adopting in-aisle checkout, embracing mobile payments and seeking out faster credit card processing.

And streamlined checkout is even more crucial in the online space, where it is not uncommon to see cart abandonment rates of 70%. The holy grail for e-Commerce is safe and speedy one-click checkout, with stored shipping and payment information that’s fully secure. If you can make checkout simpler and faster for shoppers, you’re going to get a noticeable boost on your bottom line.

So how should you prepare? Here are two fundamentals to start with: retaining customer payment preferences and ensuring payment preferences are up to date.

The beauty of 1-click checkout is that customers don’t need to re-enter payment credentials each time they shop. Enabling card-on-file payment and storing shipping data is crucial to a high conversion rate, but it’s also an area where security is truly essential. You must be sure you have the proper systems in place to securely store this information.

Not only that, seamless checkout faces yet another significant obstacle: changing credit cards numbers and expiration dates. When this happens with card-on-file purchases, the customer’s checkout flow in interrupted to ask for new payment credentials — another hurdle for the customer to climb.

At Cayan, our approach abstracts the sensitive card-on-file payment information away from the merchant’s systems as a secure token in our payment vault. That token is then returned for the transaction when the customer checks out. At the same time, we also check to be sure the payment credentials are still valid — and if not, our card account updater automatically updates the token and returns it to the retailer for a seamless checkout experience.

There are many factors that businesses need to consider as 1-click payment approaches. No matter the size of your organization, you need to start preparing now.

Keeping data (both payment card information and consumers’ Personally Identifiable Information, or PII) secure is always an issue in the payments sphere. “It should be table stakes for a retailer to keep up with their PCI audits and use payment tokenization, so that they are storing a ‘key’ and not the actual credit card information,” said Shea. The bigger challenge moving forward, however, will be the proliferation of new connected devices that include any type of commerce functionality. The IoT creates new levels of convenience and connection, but it also opens up new “attack vectors” for hackers to steal data.

“This technology is coming in rapidly, and they are at home, at work, everywhere that you are,” said Shea. “Soon you’ll be able to shop anywhere, even from your car. In the house, you have devices that respond to voice command, and there are chatbots on your phone. Retailers adopting this new technology need to think carefully around their security audits, especially around PII.”

It’s not just consumer information that can move about just a bit too freely. Retailers using RFID and beacon technology in their stores to push out product information to shoppers could also be sharing data about current inventory levels. “If a competitor got a hold of that, they would have the retailer’s product catalog and know how well things are selling in a particular store, which would provide them with an enormous competitive advantage,” said Shea.

In the brick-and-mortar environment, a different kind of friction is slowing down checkouts. Retailers and consumers that have implemented EMV technology at the POS complain that chip transactions take too long compared to the swiftness of a mag stripe swipe.

Only 44% of U.S. card-accepting merchants were equipped with EMV terminals as of September 2016, according to The Strawhecker Group (TSG), and only 29% of these merchants are actually able to accept chip-based transactions. The slow pace of adoption is an issue both for those brick-and-mortar merchants that are not yet EMV-compatible and also for online retailers, since fraudsters tend to attack the least protected parts of the commerce environment.

The pace of EMV adoption could accelerate as consumers and retailers become more accustomed to the technology and the processes around chip-based payments. “Slow transactions are still an issue, but I think they are less of one than they were even three or six months ago,” said Eric Shea, Managing Director, Kurt Salmon, part of Accenture Strategy. “There have been pretty big improvements to the networks’ speed, and consumers are sort of getting used to this.”

Some payments experts had predicted that EMV’s rocky introduction would accelerate the use of in-store payments with mobile phones. That prediction has not panned out, in large part because paying with a smartphone can actually be less convenient than using a traditional payment card.

“When everyone updated their terminals, they didn’t update the terminal logic to optimize mobile payments,” explained Brendan Miller, Principal Analyst, Forrester. “For example, I have my debit card information entered into Android Pay, and when I try to ‘tap to pay’ at a retailer, the terminal asks me for a PIN. It doesn’t need to do that because I’ve already authenticated the transaction with my thumbprint. I gave you my DNA and you still want a PIN! In other words, it takes me through the same process as it would with a credit card, so there’s no benefit for the consumer.”

The hottest trends in payment today involve small-screen transactions. The industry is “following the money”: mobile commerce growth rates are outstripping overall e-Commerce figures and continuing to accelerate. Retailers and third-party payment providers need to do everything possible to streamline and simplify checkouts and payment processes — and every step of the customer journey that leads up to them. Newly available tools, such as one-click payment options, will play important roles, but in the meantime retailers need to re-examine their own user interfaces. Even small tweaks can make a big difference in reducing abandonment rates, boosting conversions, and increasing overall customer satisfaction.

Copyright All Rights Reserved © 2018